HSBE Alternative Credit

Discover Hard-To-Access opportunities in niche private markets

HSBE Alternative Credit was founded by veteran industry professionals who have faced these problems firsthand while running Fresh Funding, a fintech originator for the last 8+ years. We invest in a portfolio of alternative, income-generating niche assets sourced from capacity-constrained and hard-to-access markets with limited competition from traditional capital.

Alternative Credit

Each underlying niche investment has a capital gap: they need capital to grow, but it is difficult to secure for one of these three reasons:

Credit Void

Outside the Scope of Regulated Banking

Non-Traditional Assets

Emerging or esoteric assets that require specialized underwriting and structuring expertise.

Limited Scale

Too Small for Larger Asset Managers to Invest

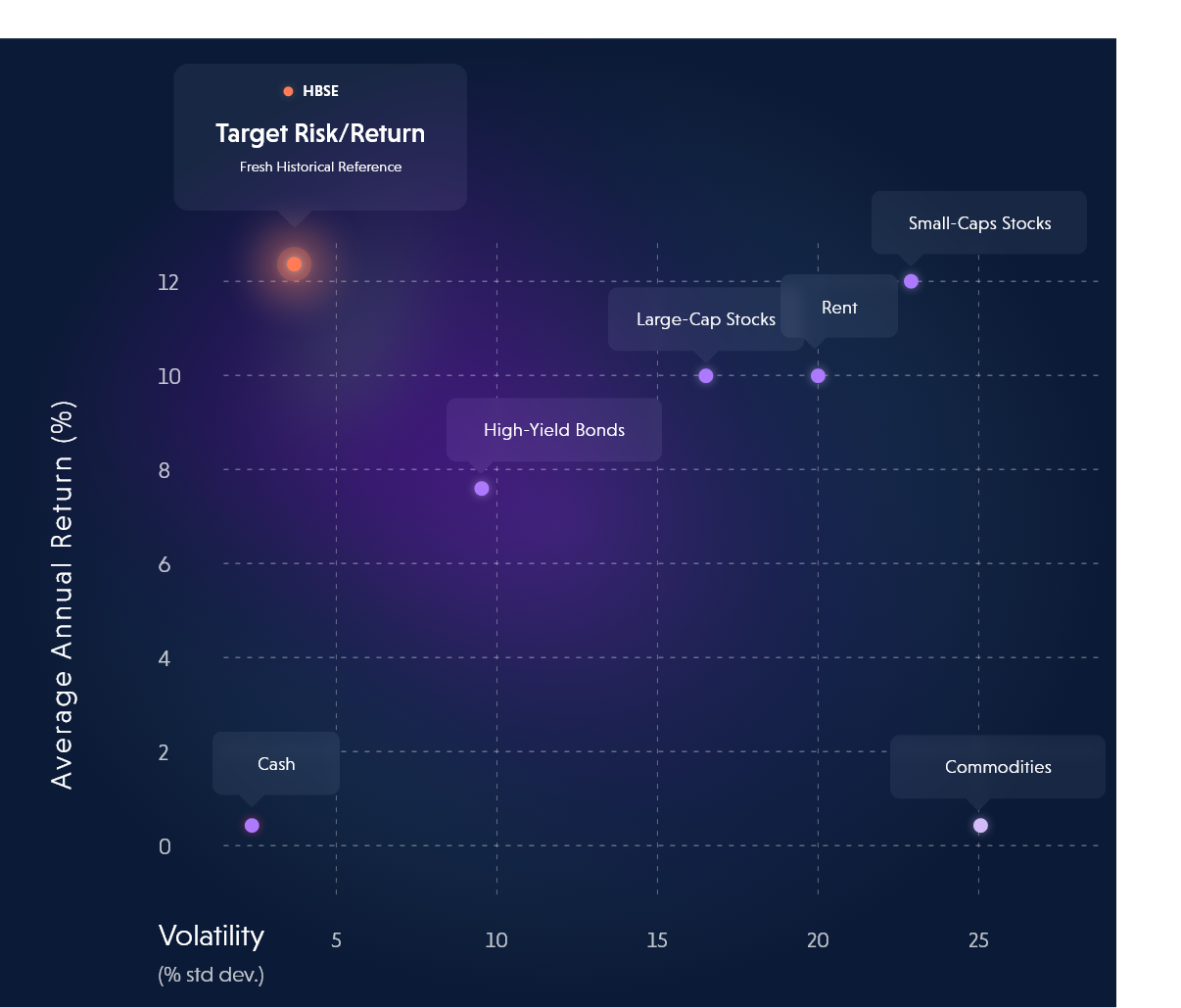

HSBE’s Returns v. Other Asset Classes

Equity-Like Returns with Limited Downside Risk

Sources:

Vanguard Advisors. “Historical Market Returns and Volatility.” Vanguard Advisors. Accessed December 2024.

Robeco. “Expected Returns 2024–2033.” Robeco. Accessed December 2024.

Financial Times. “Small-Caps: Part Deux.” Financial Times. Accessed December 2024.

HSBE’s presented performance is based on weighted averages of Fresh Funding’s historical notes.

Our strategy is focused on the new lower middle market

As credit funds raise more capital, chase larger transactions and climb up the pyramid, a New Lower Middle Market has emerged.

Better Risk Management and Downside Protection

Collateral

• Bankruptcy remote SPVs

• Collateral security interest perfection

• Cash control

Structure

• Restrictive covenants

• Personal guarantees

Concentration limits

• Industry, asset type, non-US overall and by country

Monitoring and Governance

• Weekly monitoring through investment committee

• Controlled collection account (DACA)

Credit Enhancements

• First loss

• Overcollateralization

• Interest reserves

• Backup servicers

• Excess spread

• Automatic collateral cure mechanism

Liquidity Management

• Minimum liquid marketable positions/cash

• Shorter duration, self-amortizing deal

structures offering inherent liquidity

Limited competition in niche markets means we have the power to dictate more rigid risk management terms, structures and processes than larger, more conventional corporate credit.